Robert Shiller, a renowned economist and Nobel laureate, is widely recognized for his profound insights into financial markets, particularly the housing sector. His groundbreaking work, including the development of the Case-Shiller Home Price Indices, has shaped our understanding of real estate dynamics and market trends. In this article, we delve into Shiller’s perspectives on the current housing market, examining his expert analysis and predictions. By exploring the historical context and comparing past and present trends, we aim to provide a comprehensive view of the housing market’s trajectory. Additionally, Shiller’s advice for homebuyers and investors will be highlighted, offering valuable guidance for navigating today’s real estate landscape.

Come join hopasblog.com in exploring this topic extensively.

1. Introduction to Robert Shiller and His Expertise

Robert Shiller is a distinguished economist whose work has significantly influenced our understanding of financial markets, particularly in real estate. A professor at Yale University, Shiller was awarded the Nobel Prize in Economic Sciences in 2013 for his groundbreaking research on asset prices and market volatility. He is best known for co-developing the Case-Shiller Home Price Indices, which are widely used to track changes in residential property values across the United States. Shiller’s approach combines rigorous data analysis with insights into behavioral economics, providing a nuanced perspective on market dynamics.

His influential book, “Irrational Exuberance,” explores the psychological factors driving market bubbles, including those in the housing sector. Shiller’s work emphasizes the role of human behavior and speculative tendencies in shaping market trends, offering a critical lens through which to view the housing market. His expertise extends beyond theoretical analysis, providing practical insights for both homebuyers and investors. In this article, we will explore Shiller’s current views on the housing market, drawing on his extensive research and experience to offer a comprehensive overview of market conditions and future prospects.

2. Current State of the Housing Market

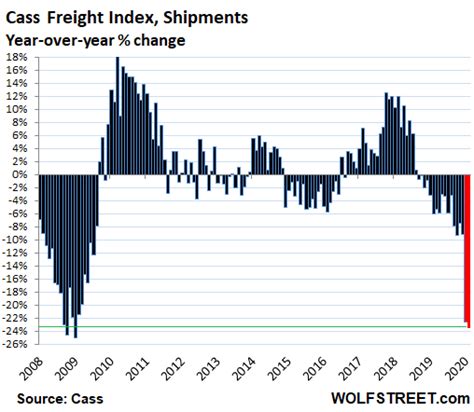

The current housing market reflects a complex interplay of economic forces, influenced significantly by recent trends and Shiller’s analysis. As of now, housing prices have shown a moderate increase in many regions, driven by persistent demand and a constrained supply of available homes. This demand is partly fueled by low mortgage rates, although these rates have been rising gradually, impacting affordability.

Shiller’s insights suggest that while the market has cooled from its peak highs during the pandemic, it remains buoyant due to continued interest from both buyers and investors. However, he highlights the potential for increased volatility, noting that recent price gains might not be sustainable in the long term. The market is also seeing a shift with more people considering remote work, influencing suburban and rural property values.

In addition to these dynamics, inflation and economic uncertainty pose risks, potentially affecting buyer sentiment and investment stability. Shiller’s perspective underscores the importance of understanding these factors to navigate the current market effectively and make informed decisions in a fluctuating environment.

3. Historical Context and Comparisons

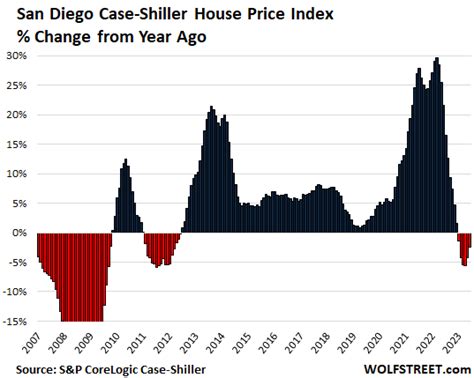

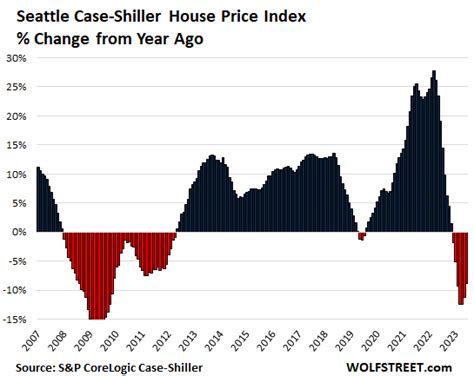

To understand the current state of the housing market, it’s crucial to consider its historical context and make comparisons with past trends. Historically, the housing market has experienced significant fluctuations driven by various economic cycles, including booms and busts. For instance, the early 2000s saw a dramatic surge in home prices, culminating in the 2008 financial crisis, which led to a severe market downturn. In contrast, the post-crisis recovery period saw steady price increases until the recent pandemic-induced spike.

Robert Shiller’s work provides valuable insights into these historical patterns. His analysis of past housing bubbles highlights how speculative behavior and external economic shocks can amplify market volatility. By comparing the current market to previous periods, Shiller’s research suggests that while some elements of the current upswing resemble past bubbles, the underlying conditions are different. For example, the role of low-interest rates and pandemic-driven shifts in work and living preferences have created a unique market environment.

Understanding these historical precedents helps in assessing whether current trends are sustainable or if they might signal the beginning of a new phase in the housing market cycle. Shiller’s perspective encourages a cautious approach, considering both historical lessons and contemporary factors.

4. Future Predictions and Potential Risks

Looking ahead, Robert Shiller’s predictions for the housing market suggest a period of increased uncertainty and potential volatility. He notes that while current market conditions show resilience, several factors could impact future trends. Rising interest rates, economic inflation, and potential regulatory changes are among the key risks that could affect housing affordability and market stability.

Shiller also highlights the possibility of market corrections if speculative behavior continues or if economic conditions worsen. The ongoing shift towards remote work and changing demographic trends could further influence future demand patterns and property values.

Investors and homebuyers should be cautious, considering these potential risks and preparing for possible fluctuations. Shiller’s insights emphasize the importance of remaining informed and adaptable in a dynamic market environment, suggesting that while opportunities exist, a careful assessment of market conditions and economic indicators will be crucial for making sound investment and purchasing decisions.

5. Advice for Homebuyers and Investors

For homebuyers and investors navigating the current housing market, Robert Shiller offers several key pieces of advice. First, he emphasizes the importance of careful financial planning and due diligence. Given the potential for market volatility, it is crucial to assess personal finances, including mortgage rates and long-term affordability, before making a purchase.

Shiller advises homebuyers to consider the long-term value of a property rather than being swayed by short-term market trends. Investing in locations with strong fundamentals—such as good schools, low crime rates, and robust economic growth—can offer greater stability and potential for appreciation.

For investors, Shiller suggests diversifying investments to mitigate risk. Rather than concentrating investments in a single property or market, spreading investments across different regions and property types can help manage potential downturns. Additionally, staying informed about economic indicators and market conditions can provide valuable insights into timing and strategic decisions.

Overall, Shiller’s advice underscores the importance of a balanced, informed approach to both homebuying and investing, focusing on long-term goals and prudent financial management.

In conclusion, Robert Shiller’s insights provide valuable guidance for understanding and navigating the current housing market. By examining historical trends and potential risks, Shiller’s expertise underscores the importance of informed decision-making for both homebuyers and investors. As the market evolves, his advice on financial planning, diversification, and long-term value remains crucial. Staying informed and considering Shiller’s perspectives can help individuals make strategic choices in an ever-changing real estate landscape.

hopasblog.com