Investing in stocks can be a lucrative way to grow your wealth, especially for real estate investors looking to diversify their portfolios. Google, now trading under the ticker symbol GOOGL, represents a compelling investment opportunity due to its strong market position and consistent financial performance. This step-by-step guide will help you navigate the process of investing in Google stock, from understanding its market presence and financial health to choosing the right brokerage account and determining the optimal time to buy. By following these steps, you’ll be well-equipped to make informed investment decisions and enhance your financial strategy.

hopasblog.com offers a detailed exploration of this topic.

1. Understanding Google Stock: An Overview

Google, officially known as Alphabet Inc., is a leading player in the technology sector, primarily known for its search engine and diverse digital services. As of now, Google trades under the ticker symbol GOOGL on the NASDAQ. Investing in Google stock offers exposure to a company that has consistently demonstrated robust financial performance and innovative growth strategies.

Founded in 1998, Google has expanded its portfolio far beyond its initial search engine, with significant ventures into cloud computing, advertising, artificial intelligence, and various consumer products. Alphabet Inc. serves as the parent company for Google and its numerous subsidiaries, providing investors with a broad spectrum of high-growth areas.

Google’s stock is known for its potential for long-term growth, driven by its dominant market position and continual innovation. The company’s substantial revenue streams, primarily from advertising, contribute to its strong financial stability and attractive valuation. Understanding Google’s business model, market influence, and growth prospects is crucial for making informed investment decisions. This overview will set the stage for delving deeper into Google’s financial health and market performance, providing a solid foundation for evaluating whether GOOGL stock aligns with your investment goals.

2. Researching Google’s Financial Health and Market Position

To make informed investment decisions, researching Google’s financial health and market position is essential. Start by examining key financial statements, including the income statement, balance sheet, and cash flow statement. Look for indicators such as revenue growth, profit margins, and earnings per share (EPS), which provide insight into the company’s profitability and operational efficiency.

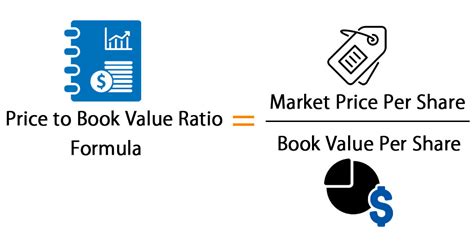

Additionally, review Google’s quarterly and annual reports to understand its performance trends over time. Assess key financial ratios like the price-to-earnings (P/E) ratio and return on equity (ROE) to gauge the stock’s valuation and the company’s ability to generate returns.

Consider Google’s competitive positioning in the tech industry, including its market share, innovation capabilities, and strategic initiatives. Analyzing these factors will help you evaluate the company’s stability and growth potential, crucial for making a well-informed investment in GOOGL stock.

3. Setting Your Investment Goals and Risk Tolerance

Setting clear investment goals and understanding your risk tolerance are crucial steps before investing in Google stock. Begin by defining your investment objectives, whether they are long-term growth, income generation, or capital preservation. Consider factors such as your financial goals, time horizon, and the amount of capital you are willing to invest.

Assess your risk tolerance by evaluating your comfort level with potential market fluctuations and losses. Google stock, while historically strong, can experience volatility. Ensure that you are prepared for the ups and downs associated with investing in technology stocks.

Establishing these parameters will help you create a tailored investment strategy. If you are seeking high returns and can tolerate significant risk, investing in Google stock may align with your goals. Conversely, if you prefer stability and lower risk, it’s important to balance your portfolio with other less volatile investments. By aligning your investment strategy with your personal goals and risk tolerance, you can make more informed and suitable investment decisions.

4. Choosing the Right Brokerage Account

Choosing the right brokerage account is a critical step in investing in Google stock. Start by evaluating different brokerage firms based on factors such as fees, account types, and available services. Look for brokers that offer competitive commission rates, especially for stock trades, as well as low account maintenance fees.

Consider the types of accounts available, such as standard brokerage accounts, retirement accounts (like IRAs), and margin accounts. Each type has different tax implications and trading capabilities. If you’re a long-term investor, a standard brokerage account might suffice, while retirement accounts offer tax advantages for long-term savings.

Assess the broker’s trading platform and tools. A good brokerage should provide a user-friendly interface, research tools, and real-time data to help you make informed decisions. Check for access to market analysis, stock performance charts, and educational resources.

Additionally, customer support and ease of account management are important. Ensure that the brokerage provides responsive support and has a reliable system for managing your investments. By carefully selecting a brokerage that aligns with your needs and preferences, you’ll be well-positioned to effectively invest in Google stock.

5. Analyzing Google’s Historical Stock Performance

Analyzing Google’s historical stock performance is crucial for understanding its past trends and potential future movements. Begin by examining Google’s stock price history over various time frames, such as one year, five years, and since its initial public offering (IPO). This will provide insight into how the stock has reacted to market conditions, economic events, and company-specific developments.

Look at historical data for key metrics, including stock price volatility, peak performance periods, and periods of decline. Review historical earnings reports and how they have influenced stock price movements. Additionally, consider Google’s response to major events, such as product launches, regulatory changes, and market competition.

Evaluate long-term trends to identify patterns and understand the stock’s resilience during market downturns. Tools like historical price charts and technical analysis indicators can help in this assessment.

By analyzing Google’s past performance, you can gauge its stability, growth potential, and how well it aligns with your investment strategy. This historical perspective will aid in making informed decisions about buying and holding Google stock.

6. Determining the Right Time to Buy Google Stock

Determining the right time to buy Google stock involves a combination of market analysis and timing strategies. Start by monitoring Google’s stock price relative to its historical performance and current market conditions. Look for price trends, support and resistance levels, and technical indicators that can signal potential buying opportunities.

Consider macroeconomic factors that might impact the stock market, such as interest rate changes, economic growth data, and geopolitical events. A favorable economic environment can enhance investor confidence and positively affect stock prices.

Evaluate Google’s recent financial performance, including quarterly earnings reports and revenue growth. Positive earnings surprises and strong financial metrics can be good indicators for a potential buying opportunity. Conversely, be cautious of any negative news or declining trends in performance.

Utilize technical analysis tools to identify entry points based on patterns, such as moving averages or relative strength indicators. Additionally, keep an eye on broader market sentiment and analyst recommendations.

Finally, consider your personal investment goals and risk tolerance. If the stock aligns with your investment strategy and you believe it is undervalued or poised for growth, it might be an opportune time to invest in Google stock.

7. Diversifying Your Investment Portfolio

Diversifying your investment portfolio is essential for managing risk and enhancing potential returns. When investing in Google stock, it’s important to balance your portfolio by including a variety of asset classes and sectors. While Google represents a strong investment opportunity, relying solely on a single stock can expose you to higher risk.

To achieve diversification, consider investing in other technology companies, as well as in different sectors such as healthcare, finance, and consumer goods. This approach helps spread risk across various industries and reduces the impact of a downturn in any single sector.

Additionally, include different types of assets, such as bonds, real estate, and mutual funds or ETFs, to further balance your portfolio. Diversification across asset classes can help stabilize returns and mitigate the impact of market volatility.

Regularly review and adjust your portfolio to maintain diversification as market conditions and your investment goals evolve. By diversifying, you can better manage risk and potentially enhance your overall investment performance while investing in Google stock.

8. Monitoring Your Investment and Making Adjustments

Monitoring your investment in Google stock and making adjustments is crucial for maintaining a successful investment strategy. Start by regularly reviewing Google’s financial performance, including quarterly earnings reports, revenue growth, and any significant news or developments related to the company. Stay informed about changes in market conditions and economic factors that could impact Google’s stock price.

Use financial tools and resources, such as stock tracking apps and market analysis reports, to keep an eye on your investment’s performance. Set up alerts for significant price movements or news that could affect Google’s stock.

Periodically assess whether Google stock continues to align with your investment goals and risk tolerance. If there are changes in your financial situation or investment objectives, you may need to adjust your holdings. This could involve buying additional shares, selling some of your position, or reallocating funds to other investments.

Rebalance your portfolio as needed to ensure it remains diversified and aligned with your overall investment strategy. By actively monitoring and adjusting your investments, you can better manage risk and take advantage of new opportunities in the market.

Investing in Google stock can be a rewarding endeavor if approached with careful planning and informed decisions. By understanding Google’s financial health, setting clear investment goals, choosing the right brokerage, analyzing historical performance, and determining the best time to buy, you set the foundation for a successful investment. Diversifying your portfolio and regularly monitoring your investments further enhance your strategy. With these steps, you can confidently navigate the process of investing in Google stock and work towards achieving your financial objectives.

hopasblog.com